Goodwin Copper Nickel

Goodwin Drilling Results 2024

GW24-01 - A 35 meter core interval grading 1.36% copper equivalent from 22.50 meters

GW24-02 - A 64.90 meter core interval grading 2.19% copper equivalent from 23.60 meters including 31.20 meters zone grading 3.84% copper equivalent.

GW-24-03 cut 60.60 meters grading 1.17% copper equivalent from 72.90 meters in the Farquharson nickel zone 900 meters to the southeast.

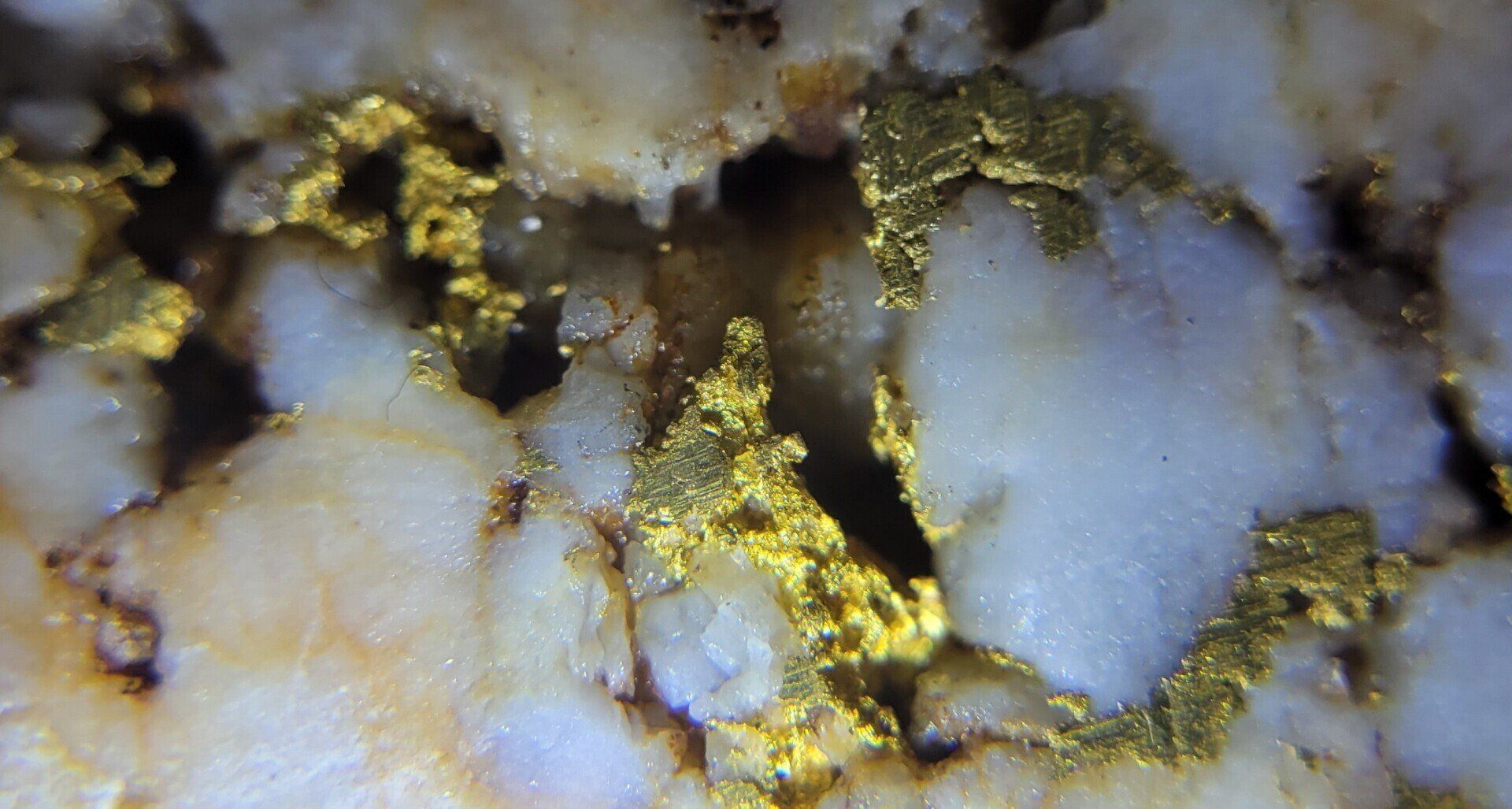

Menneval Gold Project

Multiple gold discoveries at Menneval include the Maisie vein and No 18 vein. Drill core intercepts include 56.9 g/t gold over 0.5m and 162.5 over 0.2m.

Our Projects

SLAM is committed to growing shareholder value through discovery.

CONTACT US

To request company publications or to be added to a mailing or fax list, complete the form below.